Sole Proprietorship Registration in 7 days

Fastest registration turnaround time in India with Guaranteed document upload to the government portal under 7 days or get a full refund *.

Sole Symphony: Crafting Entrepreneurial Dreams

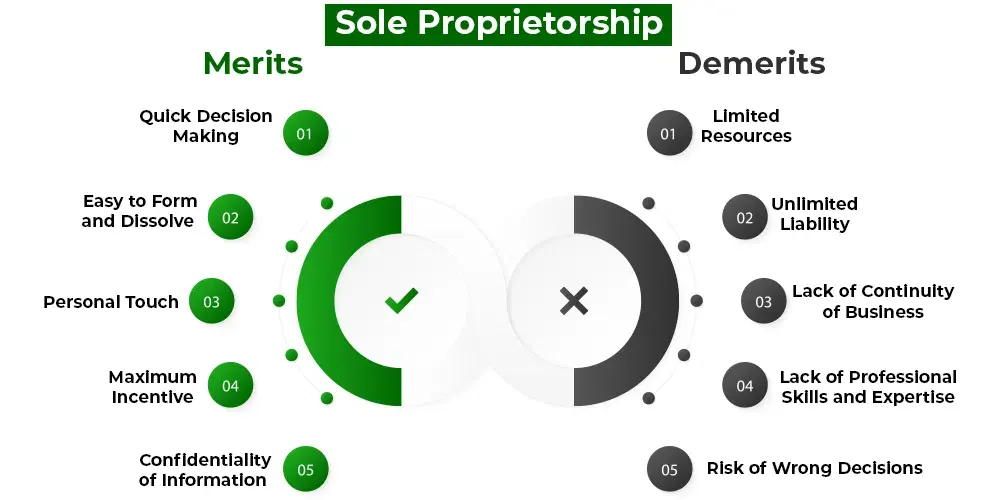

Registration of a Sole Proprietorship in India is tailored for single-owner enterprises. Sole proprietors handle profits and income tax obligations under their personal names or a chosen trade name. This structure is frequently favored by small-scale businesses and individual entrepreneurs.

When a business is solely owned and managed by one individual, it assumes the form of a sole proprietorship. This category of business can be established within a span of fifteen days, rendering it a highly favored option in the informal sector, particularly among merchants and small-scale traders. Unlike other business entities, registration for a Sole Proprietorship isn't obligatory; instead, it is identified through alternative registrations like GST registrations. Nevertheless, it's important to note that a Sole Proprietorship bears unlimited liability and lacks perpetual existence.

Documents Required for Proprietorship Registration + 1 DSC (Gov Fees Extra)

- Mobile No./Email Id

- Bank statement/Cancel Cheque

- Passport Size Photograph

- Select a location as the place of doing business

- Pan card and ID for Address proof of proprietor

- Business address proof

- Electricity bill Registered office Lease agreement

- Self attested Photograph

- Choose a business name

Checklist for a Sole Proprietorship Registration

- A certificate/license issued by Municipal authorities under the Shop & Establishment Act.

- The license issued by Registering authorities like the Certificate of Practice is issued by the Institute of Chartered Accountants of India.

- The registration/licensing document is issued in the name of the proprietary concern by the Central Government or the State Government Authority/ Department, etc,

- The banks may also accept the IEC code (Importer Exporter Code) issued to the proprietary concern by the office of the DGFT as an identity document for opening of Bank account etc.

- Complete Income Tax return online (not just the acknowledgement) in the name of the sole proprietor where the firm’s income is reflected, duly authenticated and acknowledged by the Income Tax Authorities,

- The utility bills such as electricity, water, and the landline telephone bills in the name of the proprietary concern,

- Issue of GST Registration/Certificate.

Benefits of Sole Proprietorship Firm

Sole proprietorship is a popular form of business in which an individual owns and operates a business. Some of the benefits of a sole proprietorship firm are:

Compliances for Proprietorship

Income tax: Proprietors are required to file income tax returns every year, if their total income exceeds ₹ 2.5 lakhs (for individuals below the age of 60 years) or ₹3 lakhs (for individuals above the age of 60 years).

GST: Proprietorships with a turnover of more than ₹ 20 lakhs are required to register under GST. They are required to file monthly and annual returns, and collect and remit GST on their supplies.

Shop and Establishment Act: Proprietorships that have employees are required to register under the Shop and Establishment Act of the respective state. This Act regulates the working conditions of employees, such as the hours of work, wages, and leave.

Professional tax: Proprietors who are engaged in certain professions, such as lawyers, doctors, and chartered accountants, are required to pay professional tax. The rates of professional tax vary from state to state.

Trade license: Proprietorships that operate from a physical location are required to obtain a trade license from the local authority. The requirements for obtaining a trade license vary from city to city.

Other compliances: There are a number of other compliances that may apply to proprietorships, such as environmental regulations, labour laws, and pollution control laws. The specific compliances that apply will vary depending on the nature of the business.

How Credfy Executes A Sole Proprietorship Registration?

Professional Guidance

Our experts give you professional guidance on many of the processes involved in registering your business as a sole proprietorship, along with registration of service tax, sales tax, import/export code, and professional tax.

Vendor Relationship

Our team will connect you with an established vendor who will book your application and also keep you updated on its status and progress. The vendors we have onboard are well-accomplished and skillful in managing native registrations.

15 Business Days

Our team will offer full assistance with the registration process. This could vary between 5 and 15 days, depending on the task at hand for the authorities involved.