Online AD Code Registration

This code is necessary for businesses engaged in foreign trade transactions, particularly import and export activities.

What is AD Code Registration?

AD Code registration refers to the process of obtaining an Authorized Dealer Code from the Reserve Bank of India (RBI). This code is necessary for businesses engaged in foreign trade transactions, particularly import and export activities. It serves as an identification number for the authorized dealer (typically a bank) through which foreign exchange transactions are conducted. AD Code registration ensures compliance with foreign exchange regulations and facilitates smoother international trade transactions.

Documents Required for AD Code Registration

The documents required for AD Code registration may vary depending on the bank and the type of entity applying for the code. However, the following are some of the most common documents that are required:

- IEC Registration Certificate: This certificate issued by the Directorate General of Foreign Trade (DGFT) establishes the entity's eligibility to export or import goods.

- Bank Account Details: This includes the name of the bank, the branch address, the account number, and the IFSC code.

- Proof of Identity: A PAN card, Aadhaar card, passport, or voter ID card.

- Proof of Address: This could be a utility bill, a lease agreement, or a property registration document.

- Board Resolution: This is a resolution passed by the entity's board of directors authorising the registration of the AD Code.

- Letter of Authorisation: This is a letter from the authorised signatory of the entity authorising the person applying for the AD Code to do so on their behalf.

Applying for an AD Code

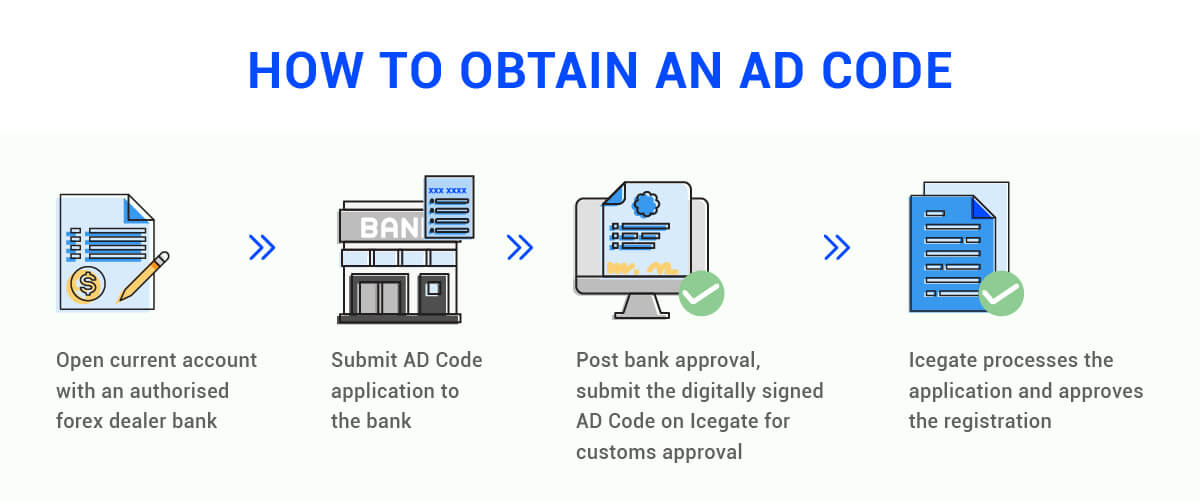

To apply for an AD Code, you'll need to complete two main steps:

Visit your bank branch: Go to the bank where you maintain your current business account.

Submit an application letter: Request the bank to issue an AD Code for your business. The bank will likely provide a specific format for this letter. Be sure to include all necessary details like your IEC number, GST registration number, and desired port locations.

Provide supporting documents: The bank might require documents like your PAN card, bank account details, and proof of business address.

Pay the applicable fees: There might be a processing fee associated with issuing an AD Code.

Benefits of AD Code Registration

List of Ports / ICD for AD Code Registration

AD Code registration is required for all ports in India. The list of ports is as follows:

- Chennai

- Cochin

- Kolkata

- Mumbai

- New Delhi

- Kandla

- Visakhapatnam

- Haldia

- Paradip

- Mangalore

- Tuticorin

- To prevent illegal outflow of foreign exchange: The AD Code helps to track all foreign currency transactions and to identify any suspicious activity. This helps to prevent the illegal outflow of foreign exchange, which can be used for terrorist financing or other illegal activities.

- The AD Code is only issued to entities engaged in genuine trade activities to ensure that foreign currency transactions are for genuine trade purposes. This helps to prevent the use of foreign currency for illegal purposes, such as money laundering.

- To facilitate the export and import process, AD Code registration is a necessary requirement for exporters and importers who deal in foreign currency. It helps to speed up the export and import process and to avoid delays at customs.

- To avail of government incentives and schemes: The government offers a number of incentives and schemes to exporters and importers. AD Code registration is a requirement for many of these schemes.

Why is AD Code Registration Required?

AD Code registration is required to ensure that foreign currency transactions are genuine and not used for illegal purposes. The AD Code is a unique identification number issued by a bank to an exporter or importer. It is used to track all foreign currency transactions and to prevent money laundering and other financial crimes.

CLRA Registration & LicensingFAQ's

There are two primary ways to check your AD Code registration status:

Bank Account Management on ICEGATE:

Login to your ICEGATE account (https://www.icegate.gov.in/: https://www.icegate.gov.in/) with your PAN and password.

Go to 'Services' > 'Bank Account Management.'

Find your AD Code account and the status will be displayed.

Contact your bank:

Your bank can confirm your AD Code registration status and provide details like the authorized ports.