Corporate Tax in India

Reduce the tax burden on your firm. Pay corporate tax in India on time, that too in just a few clicks through Credfy.

Corporate Tax in India

A corporation is a company that is separate from its shareholders legally. Both domestic and foreign businesses are required to pay corporate tax in India under the Income-tax Act. In order to calculate the corporate tax in India the companies are further categorised as domestic and foreign companies. The domestic companies are registered under the Indian Companies Act. It involves any company that has its entire business and management in India.

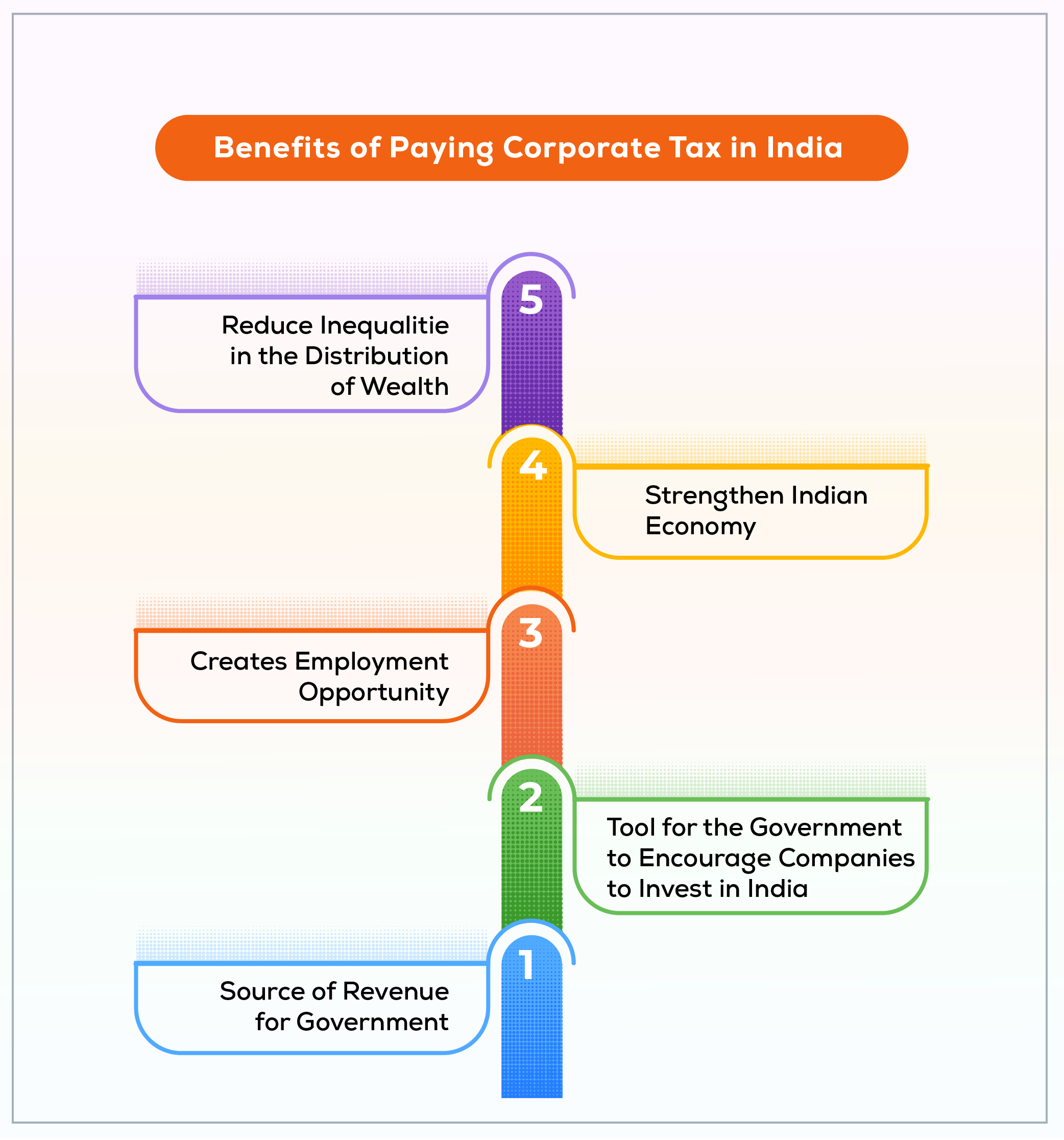

Benefits of Corporate Tax in India

- Corporate tax in India is a crucial component of every tax system, particularly in developing nations with few other sources of income. Due to the relatively high corporate taxes, substantial sums of money are raised for public projects

- Perhaps most significantly, personal income taxes are primarily protected by corporate tax in India. Rich people increasingly shift their profits from the personal tax bracket to corporate tax in India as the income tax rates for companies are less when compared to the personal tax rates

- Companies all across the world are supported by unused, uninvested capital deposits totaling trillions of dollars. They are like a string; cutting their taxes won't increase expenditure or output. Some claim that corporate tax in India are a crucial democratic check on excessive corporate power.

Checklist for Corporate Tax

- Account balance for year-end transactions

- Specify If this is your first year submitting corporate tax in India

- Address of the business corporation, business number, name of the business corporation, number, and date of incorporation

- Name and share percentages of the shareholders main product or service of the business

- Phone number and name of the president or director

- Previous years' corporation tax returns if available