Online Professional Tax Registration

Don’t risk paying penalties. Get our experts to register you for professional tax today!

Online Professional Tax Registration

Professional tax registration is crucial for individuals and employers to obtain a certificate and fulfil their tax obligations. Employers must get PT registration within 30 days of hiring employees and deduct professional tax from their salaries.

Professionals starting their practice must get P tax registration online within 30 days as well. In some cases, employers may need both PT registration and profession tax payment certificate. At Credfy.in, we specialise in simplifying the professional tax registration process, ensuring compliance and ease of taxation. Contact us to streamline your tax obligations today.

Professional Tax Applicability

Professional tax is a tax levied on individuals who earn income from a profession, trade, or calling. The applicability of professional tax varies from state to state. However, some of the common professions that are subject to professional tax include:

- Doctors

- Lawyers

- Chartered accountants

- Engineers

- Architects

- Teachers

- Other professionals who earn a salary or fee

Professional Tax Rate and Applicable States across India

The professional tax rate also varies from state to state. However, the rates are typically in the range of Rs. 200 to Rs. 500 per annum. The professional tax rate may be higher for certain professions, such as doctors and lawyers.

- Andhra Pradesh

- Arunachal Pradesh

- Assam

- Bihar

- Chhattisgarh

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu and Kashmir

- Jharkhand

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Odisha

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal.

Documents Required for Professional Tax Registration

- PAN card of the professional

- Aadhaar card of the professional

- Proof of address of the professional

- Proof of identity of the professional

- Proof of registration of the business, if applicable

- Proof of income, if applicable

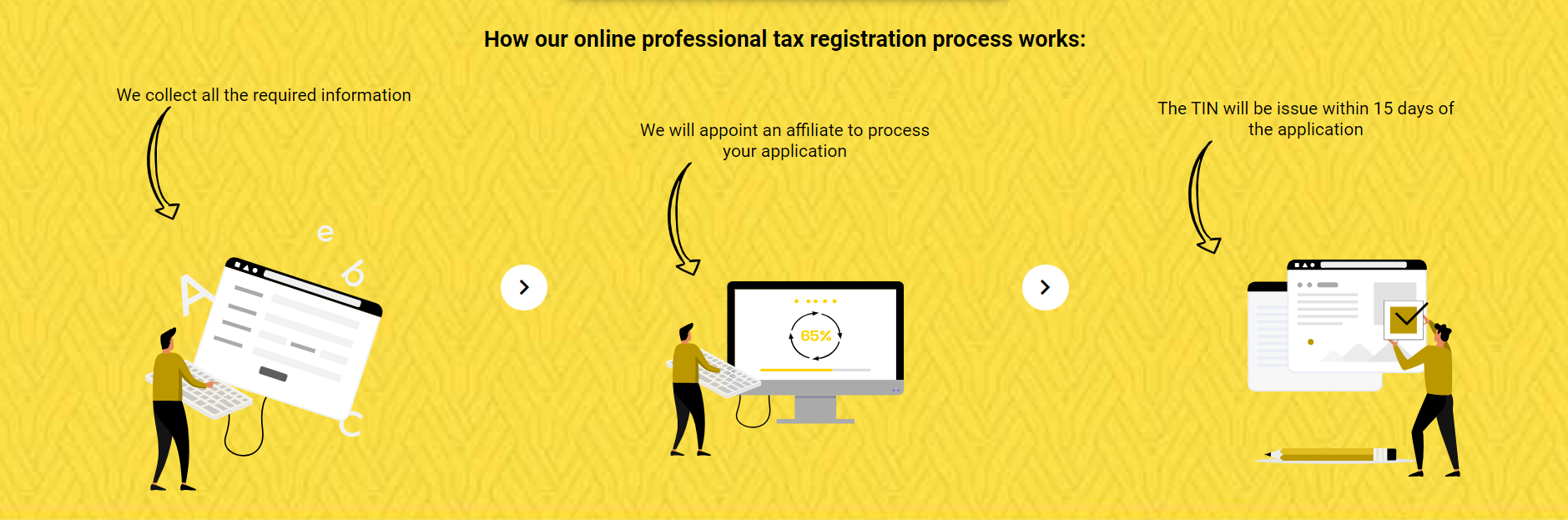

Detailed Process of Online Professional Tax Registration

Step 1: Client Engagement and Information Gathering

Credfy experts engage with the client to understand their requirements and gather all the necessary information for professional tax registration.

Step 2: Online Portal Registration and Application Submission

Our experts will register on behalf of the client. We will submit the self-assessment application for professional tax registration.

Step 3: Document Collection and Upload

Credfy.in experts collect all the required documents from the client, including certificates, proofs, and other relevant information. They then upload these documents along with the application on the online portal.

Step 4: Verification and Confirmation

Credfy.in experts assist the client in making the necessary payment for professional tax registration. Once the application is submitted, they receive an acknowledgement slip containing the professional tax Registration Number (PTNAN).

Step 5: Payment and Acknowledgement

Credfy.in experts ensure that the submitted application and documents are verified by the Assistant Revenue Officer (ARO) of the respective zone. The ARO may revise the tax demand if necessary or confirm the assessment, completing the professional tax registration process.