Online Startup India Registration

Credfy is the Best Service Provider for Your Startup India Registration Needs

Section 8 Company Registration?

The Startup India Scheme, launched by the Government of India in January 2016, aimed to foster entrepreneurship and promote innovation by providing various incentives and support mechanisms to startups across the country. The initiative was introduced to create a conducive ecosystem for startups to thrive and contribute to economic growth and job creation.

One of the key features of the Startup India Scheme is the simplification and liberalization of regulatory norms, making it easier for startups to register and operate their businesses. Startups are eligible for benefits such as self-certification, exemption from inspection for the first three years, and fast-track patent examination at reduced costs. These measures aim to reduce the bureaucratic hurdles that often hinder the growth of startups.

Financial support is another crucial aspect of the scheme. The government has established a Fund of Funds for Startups (FFS) with a corpus of ₹10,000 crores to provide equity funding to eligible startups. Additionally, various financial institutions and venture capital funds have been roped in to support startups through loans, grants, and other financial instruments.

Documents Required for Startup India Scheme

To register for Startup India, startups must provide certain documents, which may include:

- Certificate of incorporation/registration

- PAN card of the company

- Address proof of the company

- Brief description of the business

- Details of the directors or partners

- Letter of recommendation from an incubator or industry association

- A patent filed and published in the name of the startup

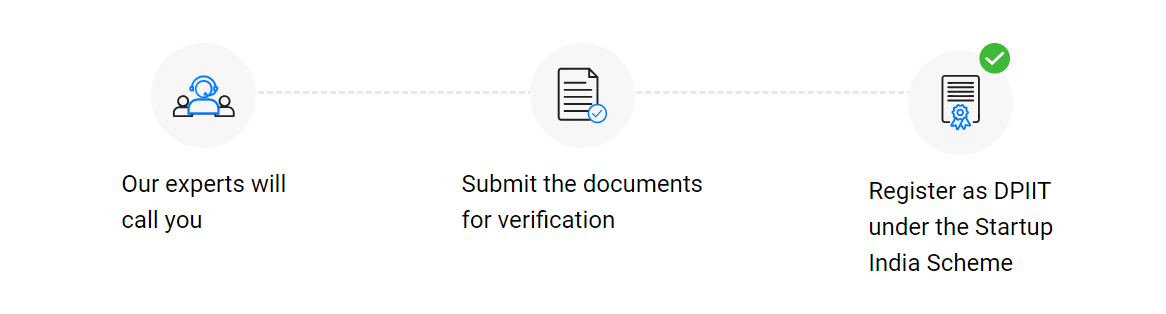

Steps Involved in Startup India Scheme Registration

Who is Eligibile for Startup India Scheme

Company Registration: The company must be incorporated as a private limited company,partnership firm or a limited liability partnership. An incubation fund, an angel fund, or a private equity fund must finance the business in order for DIPP to approve it.

Have Patron Guarantee From: The company should have received a patron guarantee from the Indian Patent and trademark office. Also It requires a recommendation letter from an incubator.

Company Existence: The company should be brand-new or no more than five years old, and its annual revenue should not exceed ₹25 crores.Innovative and Scalable Entity: The entity should be working towards innovation, development, or improvement of products or processes or services. It is a scalable business model with a high potential for employment generation or wealth creation.

Checklist of Startup India Scheme

- The company must be incorporated as a private limited company, partnership firm or a LLP

- An incubation fund, angel fund, & pef must finance the business in order for DIPP to approve it

- The company should have received a patron guarantee from Indian Patent & trademark office

- It requires a recommendation letter from an incubator

- For networks, SEBI registration is necessary under Startup India Scheme

- The company should be brand-new or no more than 5 years old, and its annual revenue should not exceed ₹25 crores

- The Startup India campaign does not impose income tax on capital gains

- Capital gain is exempt from income tax

- It is working towards the innovation, development, or improvement of products or processes or services

- It is a scalable business model with a high potential for employment generation or wealth creation.

Benefits of Startup India Scheme

The benefits of the Startup India Scheme are as follows:

Income Tax Benefits

Startups are now given an income tax exemption for a period of three years from the date of incorporation provided they are certified as such by the Inter-Ministerial Board of Certification. Also, upon obtaining recognition from the Department for Promotion of Industry and Internal Trade (DPIIT) and if the aggregate amount of paid-up share capital and share premium of the startup after the proposed issuing of shares, if any, does not exceed ₹25 Crore, the startup will also be exempt from capital gains tax under Section 56 of the Income-tax Act, 1961-2014.

Financial Benefits

Startups are given a rebate on intellectual property rights (IPR) costs of 80% on patents and 50% on trademarks and are actively assisted by government-provided facilitators who aid with protecting and commercialising the IPRs. The examination and disposal of the IPR applications are also fast-tracked. The government will also pay the fees of the facilitators.

Registration Benefits

Startup registration in India is still extremely complex, with incorporation and registration being considered more difficult than the actual running of a business due to the extensive requirements. Under the scheme, it provides a portal to create networking opportunities and assistance for startups. A problem-solving window has been provided by the government under the scheme.

Funding Benefits

Certain states provide seed funding to startups certified under the scheme. To know about your state and the requirements in place.

Startup India Scheme: Regulatory Benefits

Under this scheme, startups are allowed to self-certify compliance for six labour laws and three environmental laws through a simple online procedure. For labour laws, no inspections will be conducted for a period of 5 years unless there is a credible and verifiable complaint of violation, filed in writing, and approved by an official who is at least one level senior to the inspecting officer.

In the case of environmental laws, startups that fall under the ‘white category’ (as defined by the central pollution control board) would be able to self-certify compliance, and only random checks would be carried out in such cases

Public Procurement Benefits

Once your startup is certified by the Inter-Ministerial Board of Certification and a DIPP (Department of Industrial Policy and Promotion) number will be issued to you, you can get listed as a seller on the Government of India’s e-procurement portal – Government e-Marketplace – and have the inside track on all Government of India Ministries/Departments/Public Sector undertakings subject to your ability to meet quality and technical requirements. Certified startups under the Startup India scheme will also be entitled to exemptions on the earnest money deposit in your bid as well as in terms of the requirements regarding prior turnover and experience.

Faster Exit Benefits

The government has initiated provisions making winding down operations easier by appointing an insolvency professional to fast-track the closure of operations and facilitate the sale of goods as well as paying creditors, all while recognising limited liability. Startups with a simple debt structure or those meeting the criteria outlined under this scheme will be able to achieve a complete exit within 90 days.