Online GST Returns Filing

GSTIN is a 15 digit unique identification number given to each GST taxpayer.

What is GST Return Filing?

A GST return is a document where a taxpayer reports income, expenses, sales, purchases, and tax liability to tax authorities using their GSTIN. It provides essential details for tax administrative authorities.

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India. Every taxpayer registered under GST has to file GST returns. These returns are used to calculate the tax liability by the government. GST is an evolving system of taxation and the government keeps updating the rules and regulations around it. So, it is important to stay up-to-date to be able to file your returns correctly. Our GST return filing service helps taxpayers to get it done easily. Our professionals will take care of the filings so you don’t have to worry about keeping up with the due dates and staying GST compliant.

Documents Required for GST Return Filing

- Invoices issued to persons with GSTIN or B2B invoices

- Invoices issued to persons without GSTIN or B2C invoices

- This needs to be submitted only when its total value is above ₹2.5 lakhs

- A consolidation of inter-state sales

- HSN-wise summary of all goods sold

- Any other debit or credit notes or advance receipts

Who Is Eligible for GST Return?

- Taxpayers who did not choose the QRMP plan are required to file two monthly returns and one yearly return under the GST system

- QRMP filers must submit nine GSTR files annually, which include four GSTR-1 and three GSTR-3B forms as well as an annual return. It should be noted that even if QRMP filers submit their returns on a quarterly basis, they must pay tax on a monthly basis

- Additionally, separate statements and returns must be filed in other circumstances, such as in the case of composition dealers, who must submit five GSTR files annually (4 statement-cum-challans in CMP-08 and 1 annual return GSTR-4).

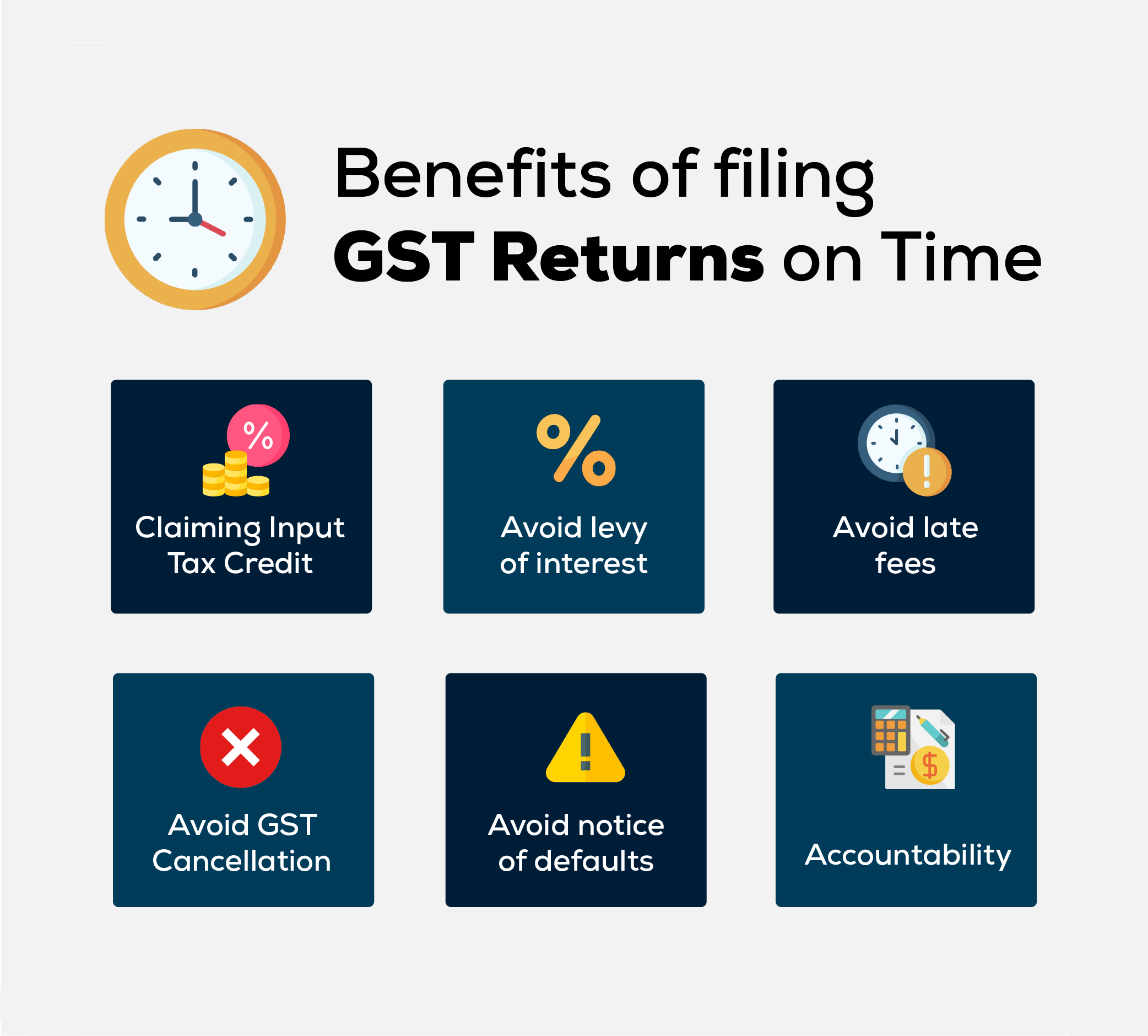

Benefits of GST Return Filing

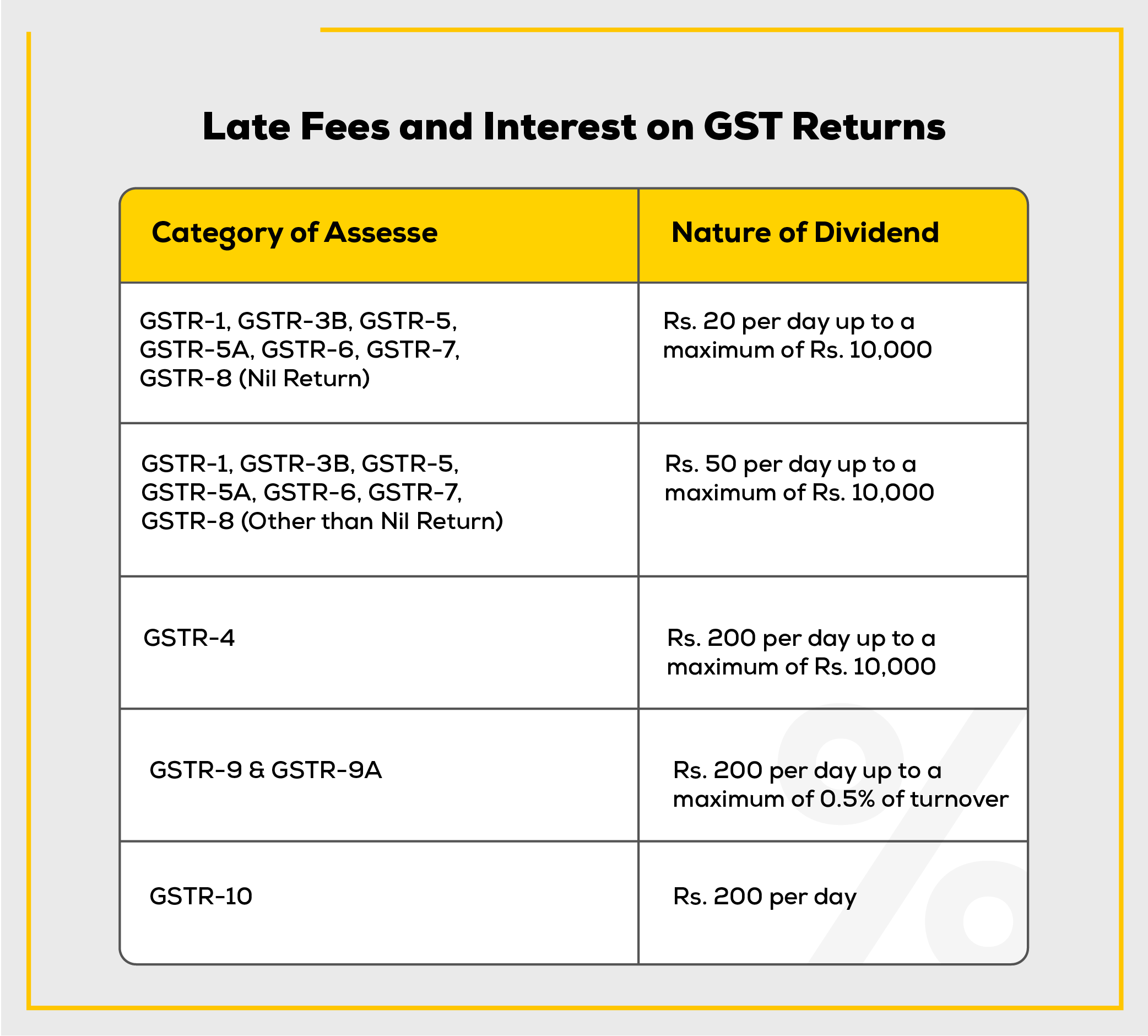

GST Return Late Fee & Interest

Penalty for Late Filing

| Type of Offence | Penalty | Type of Offence | Penalty |

|---|---|---|---|

| Late Filing: | - ₹100 per day during which the failure continues, up to a maximum of ₹5,000 | Late Filing: | - ₹100 per day during which the failure continues, up to a maximum of ₹5,000 |

| - ₹100 per day during which the failure continues, subject to a maximum of quarter percent of the person’s turnover in the state where he is registered for annual return | - ₹100 per day during which the failure continues, subject to a maximum of quarter percent of the person’s turnover in the state where he is registered for annual return | ||

| Late Payment of Tax: | Interest on the tax due calculated from the first day the tax was due to be paid | Late Payment of Tax: | Interest on the tax due calculated from the first day the tax was due to be paid |

| Excess Claim of Input Tax Credit or Reduction: | Interest on the undue excess claim or undue reduction in output tax liability | Excess Claim of Input Tax Credit or Reduction: | Interest on the undue excess claim or undue reduction in output tax liability |

| Delayed Payment to Supplier: | Interest on the amount due added to the recipient’s liability | Delayed Payment to Supplier: | Interest on the amount due added to the recipient’s liability |

| Cancellation of Registration: | Registration may be canceled if: | Cancellation of Registration: | Registration may be canceled if: |

| - Regular dealer hasn't furnished returns for 6 continuous months | - Regular dealer hasn't furnished returns for 6 continuous months | ||

| - Composition dealer hasn't furnished returns for 3 quarters | - Composition dealer hasn't furnished returns for 3 quarters | ||

| - Voluntary registered person hasn't commenced business within 6 months of registration | - Voluntary registered person hasn't commenced business within 6 months of registration | ||

| - Registration obtained by fraud, wilful misstatement, or suppression of facts | - Registration obtained by fraud, wilful misstatement, or suppression of facts | ||

| Confiscation of Goods and/or Conveyances: | Confiscation of goods and/or conveyances and fine of ₹10,000 or an amount equal to the tax evaded | Confiscation of Goods and/or Conveyances: | Confiscation of goods and/or conveyances and fine of ₹10,000 or an amount equal to the tax evaded |

| Imprisonment and Fine: | Imprisonment and fine applicable for specific offenses | Imprisonment and Fine: | Imprisonment and fine applicable for specific offenses |

| Other Penalties: | - ₹10,000 or amount equivalent to the tax evaded for specified offenses | Other Penalties: | - ₹10,000 or amount equivalent to the tax evaded for specified offenses |

| - Penalty of up to ₹25,000 for aiding or abetting offenses listed above | - Penalty of up to ₹25,000 for aiding or abetting offenses listed above |

Various GST Returns

GSTR-1 is the returnfor reporting details of all outward suppliesand also for reporting debit and credit notes issued. In short, return for reporting all sales transactions made during a tax period.

WHO : To be filed by all regular GST taxpayers.

FREQUENCY : It is to be filed monthly, except in the case of small taxpayers with turnover up to Rs.1.5 crore, who can file the same on a quarterly basis.

DUE DATE : 11th of the following month

GSTR-2 is the return for reporting details of all inward supplies. In short, return for reporting all purchases made during a tax period.

WHO : To be filed by all regular GST taxpayers.

DUE DATE : SUSPENDED

GSTR-3 is a monthly summary return for furnishing summarized details of all outward supplies made, inward supplies received and input tax credit claimed, along with details of the tax liability and taxes paid.

WHO : To be filed by all regular GST taxpayers.

DUE DATE : SUSPENDED

GSTR-3B is a monthly self-declaration to be filed, for furnishing summarized details of all outward supplies made, input tax credit claimed, tax liability ascertained and taxes paid.

WHO : To be filed by all regular GST taxpayers.

FREQUENCY : It is to be filed monthly

DUE DATE : 20th of the following month

GSTR-3B is a yearly return to be filed by taxpayers who have opted for the Composition Scheme under GST.

WHO : To be filed by all regular GST taxpayers.

FREQUENCY : It is to be filed annually

DUE DATE : 30th April of the next Financial year

GSTR-5 is the return to be filed by non-resident foreign taxpayers, who are registered under GST and carry out business transactions in India. The return contains details of all outward supplies made, inward supplies received, credit/debit notes, tax liability and taxes paid.

WHO : To be filed by all regular GST taxpayers.

FREQUENCY : It is to be filed monthly

DUE DATE : 20th of the following month

GSTR-6 is a monthly return to be filed by an Input Service Distributor (ISD). It will contain details of input tax credit received and distributed by the ISD. It will further contain details of all documents issued for the distribution of input credit and the manner of distribution.

WHO : To be filed by all Input Service Distributor

FREQUENCY : It is to be filed monthly

DUE DATE : 13th of the following month

GSTR-7 is a return to be filed by persons required to deduct TDS (Tax deducted at source) under GST. GSTR 7 will contain details of TDS deducted, the TDS liability payable and paid and TDS refund claimed, if any.

WHO : To be filed by all persons required to deduct TDS

FREQUENCY : It is to be filed monthly

DUE DATE : 10th of the following month

GSTR-8 is a return to be filed by e-commerce operators registered under the GST who are required to collect tax at source (TCS). GSTR-8 will contain details of all supplies made through the E-commerce platform, and the TCS collected on the same.

WHO :To be filed by all e-commerce operators

FREQUENCY : It is to be filed monthly

DUE DATE : 10th of the following month

GSTR-9 is the annual return to be filed by regular taxpayers registered under GST.

WHO : To be filed by all regular GST taxpayers

FREQUENCY : It is to be filed annually. (GST Council meeting took the decision to make GSTR-9 filing optional for businesses with turnover up to Rs.2 crore in FY 17-18 and FY 18-19 )

DUE DATE :31st December of next financial year

GSTR-9A is the annual return to be filed by taxpayers who have registered under the Composition Scheme.

WHO : To be filed by all composition GST taxpayers

FREQUENCY : It is to be filed annually. (GST Council meeting took the decision to waive off GSTR-9A filing for FY 17-18 and FY 18-19 )

GSTR-9C is the reconciliation statement to be filed by all taxpayers registered under GST whose turnover exceeds Rs.2 crore in a financial year. The registered person has to get their books of accounts audited by a Chartered/Cost Accountant. The statement of reconciliation is between these audited financial statements of the taxpayer and the annual return GSTR-9 that has been filed.

WHO : To be filed by all GST taxpayers having turnover more than Rs.2 crore in a financial year

FREQUENCY : It is to be filed annually.

GSTR-10 is to be filed by a taxable person whose registered has been cancelled or surrendered. This return is also called a final return.

FREQUENCY : It is to be filed once, when GST Registration is cancelled or surrendered

DUE DATE : Within three months of the date of cancellation or date of cancellation order, whichever is later.

GSTR-11 is the return to be filed by persons who have been issued a Unique Identity Number(UIN) in order to get a refund under GST for the goods and services purchased by them in India. GSTR-11 will contain details of inward supplies received and refund claimed.

FREQUENCY : It is to be filed monthly