Revocation of GST Registration Cancellation

Revocation of GST registration in 3 steps. Active GSTIN provided and quick revocation assured

Revocation of Cancellation of GST Registration

Nowadays, GST is one of the most discussed topics in India. All of us are still confused about the method for registration, filling the return forms, tax challan, e-way bill and other forms for GST. If you have mistakenly registered for GST and are required to cancel your GST registration, one can only do so if the annual turnover of his/her company is less than ₹20 lakhs that is the total of sales plus unregistered purchase.

Reasons for GST Cancellation

- Cancellation occurs when turnover is less than 20 lakhs

- Cancellation by the taxpayer in other cases like discontinuation of business, conversion of business

- Cancellation by a tax officer, if the business does not follow the established parameters.

Time Limit for Revocation of GST Registration

Within 30 days of the date the order of cancellation of GST registration was served, any registered taxable person may apply for the revocation of that cancellation. Please note that the option for GST revocation is only available in cases where the registration has been cancelled by the proper officer voluntarily. Revocation is not applicable when a taxpayer chooses to cancel their GST registration voluntarily.

Application for Revocation of GST Registration

The cancellation of the taxpayer's registration may be reversed if the appropriate officer is satisfied with the justification given by the taxpayer for doing so.

GST Revocation by the proper officer is only permitted for a period of 30 days following the application date. The appropriate officer must sign an order revoking the registration cancellation in FORM GST REG-22.

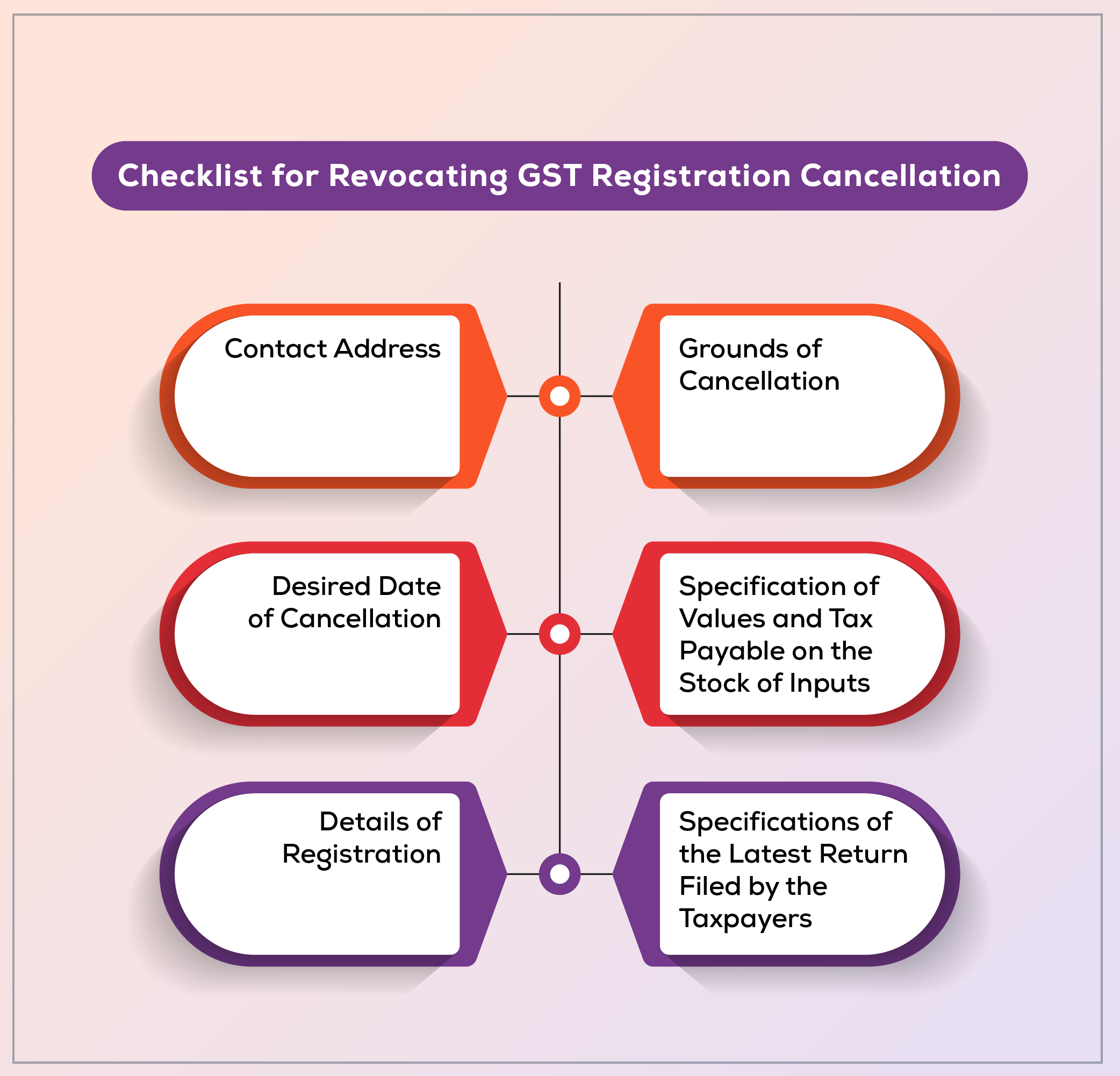

Checklist for Revocation of GST Registration ?

FAQ's on Revocation of GST Registration

A revocation means the proper cancellation of a declaration or agreement. Revocation of cancellation of registration means that the choice to cancel the enrollment has been changed and the registration is still valid.

GST registration can be removed by any person who is no longer needed to file GST return if both his/her yearly turnover is under the exemption limit or the taxpayer is no longer likely to be a registered person or any other purpose described below.

As far as the cancellation of registration is involved, you have to register all your returns and prepare all your dues with the GST department for the cancellation of your enrollment. You cannot continue ahead for cancellation unless and until you clear all your dues.